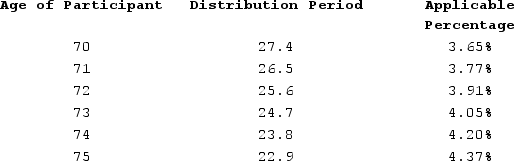

Sean (age 72 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,760,000 and the balance in his account on December 31, 2020, was $1,825,000. In 2020, Sean received a distribution of $65,000 from his 401(k)account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $65,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining the required minimum distribution penalty, if any).

Definitions:

Q4: Lenter LLC placed in service on April

Q6: Pure Action Cycles Incorporated, a bicycle manufacturer,

Q29: Kimberly's employer provides her with a personal

Q48: Annika's employer provides each employee with up

Q53: Riley participates in his employer's 401(k)plan. He

Q57: Which of the following statements is true

Q76: The 200 percent or double declining balance

Q77: In certain circumstances, a taxpayer could rent

Q88: Bryan, who is 45 years old, had

Q122: Assets held for investment and personal use