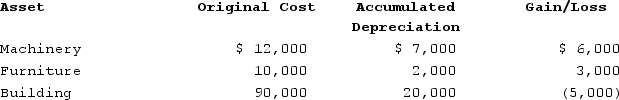

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Third-Party Users

Individuals or entities that are not directly involved in a contract or transaction but who may be affected by it or have rights or obligations arising from it.

Accountant-Client Privilege

The right of an accountant to not reveal any information given in confidence by a client. The privilege is not granted by every state or by the federal government.

Demanding Payment

The act of formally or informally requesting the settlement of a sum of money owed from a debtor.

Accounting Services

Professional services involving the recording, reporting, and analysis of financial transactions of a business or individual.

Q19: For a home to be considered a

Q25: Ethan (single)purchased his home on July 1,

Q28: Employer's expense for stock options is typically

Q57: An audience is looking for a speaker

Q61: Assume that Bethany acquires a competitor's assets

Q74: To help parties involved trust a mediator,

Q86: Assume that Cannon LLC acquires a competitor's

Q110: Roth LLC purchased only one asset during

Q111: Dean has earned $70,000 annually for the

Q145: Lisa, age 45, needed some cash so