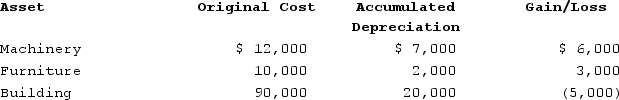

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Marginal Utility

The change in satisfaction or utility an individual gains from consuming an additional unit of a good or service.

Efficient

The quality of achieving maximum productivity with minimum wasted effort or expense.

Utility Functions

Mathematical representations that indicate the level of satisfaction or utility an individual receives from consuming different bundles of goods and services.

Clothing

Textile-based materials worn on the body, primarily used for protection, modesty, and decoration.

Q7: The first step in the postimplementation phase

Q9: Koch traded Machine 1 for Machine 2when

Q34: Storytelling is one of the oldest, most

Q36: In organizations, the two kinds of conflicts

Q43: Your cousin Vicky remodelled an old beach

Q53: Bad Brad received 20 NQOs (each option

Q61: In Herzberg's two-factor theory of motivation, hygiene

Q87: Deirdre's business purchased two assets during the

Q88: Bryan, who is 45 years old, had

Q111: Katy owns a second home. During the