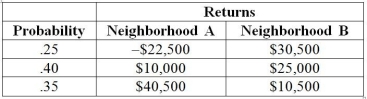

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if you can invest 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B, what is the portfolio expected return of your investment?

Definitions:

Bins

Containers or designated spaces used for storing inventory items in a structured manner.

Operating Leverage

A financial metric that measures the degree to which a firm or project can increase operating income by increasing revenue.

Variable Costs

Expenses that fluctuate based on the amount of output or the level of activity in a business.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, highlighting the fixed versus variable costs of a business.

Q1: For sample sizes greater than 30,the sampling

Q14: As a population becomes large,it is usually

Q30: Referring to Table 4-5,if a package selected

Q44: Referring to Table 3-3,the first quartile of

Q48: In inferential statistics,the standard error of the

Q81: The amount of time required for an

Q116: The amount of tea leaves in a

Q130: Data on the change in the cost

Q159: Referring to Table 4-9,if a randomly selected

Q177: Referring to Table 6-2,the probability is 0.75