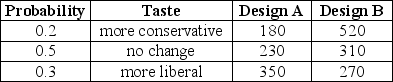

TABLE 5-8

Two different designs on a new line of winter jackets for the coming winter are available for your manufacturing plants. Your profit (in thousands of dollars) will depend on the taste of the consumers when winter arrives. The probability of the three possible different tastes of the consumers and the corresponding profits are presented in the following table.

-Referring to Table 5-8, if you decide to choose Design A for 10% of the production lines and Design B for the remaining production lines, what is the risk of your investment?

Definitions:

Temporary Difference

Differences between accounting income and taxable income that are expected to reverse in the future, affecting deferred tax calculations.

Permanent Difference

Transactions that cause a difference between the tax basis and the book value of assets and liabilities, which will not reverse over time.

Interperiod Tax Allocation

The process of allocating income taxes over different accounting periods due to temporary differences between financial accounting and tax reporting.

Intraperiod Tax Allocation

The process of allocating income taxes between different parts of the financial statements within the same fiscal period.

Q41: The owner of a fish market determined

Q50: Referring to Table 5-11,what is probability that

Q59: Referring to Table 6-1,a single Monday is

Q61: Referring to Table 4-8,what is the probability

Q70: The amount of bleach a machine pours

Q72: Which of the following can be reduced

Q123: Referring to Table 3-4,the variance of the

Q126: The employees of a company were surveyed

Q139: The amount of time necessary for assembly

Q214: The number of 911 calls in Butte,Montana,has