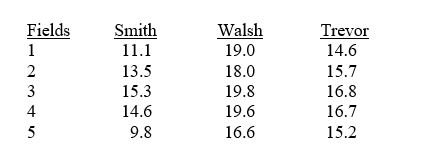

TABLE 11-6

An agronomist wants to compare the crop yield of 3 varieties of chickpea seeds. She plants all 3 varieties of the seeds on each of 5 different patches of fields. She then measures the crop yield in bushels per acre. Treating this as a randomized block design, the results are presented in the table that follows.

-Referring to Table 11-6, based on the Tukey multiple comparison procedure with an overall level of significance of 0.01, the agronomist would decide that there is a significant difference between the crop yield of Smith and Walsh seeds.

Definitions:

Payroll Taxes

Contributions required from employers and their workers, determined as a portion of the payroll expenses incurred by the employer.

Workers

Individuals engaged in any form of productive activity, typically in exchange for wages or salaries.

Corporate Profits Tax

A levy placed on the profit of corporations, calculated as the net income of the firm after deducting costs and expenses.

Individual Income Tax Rate

The percentage of an individual’s income that is paid to the government as tax.

Q24: Referring to Table 12-9,the calculated test statistic

Q66: Referring to Table 9-9,state the null hypothesis

Q90: Referring to Table 11-6,the relative efficiency means

Q91: Referring to Table 12-12,suppose we want to

Q110: The symbol for the power of a

Q124: The owner of a local nightclub has

Q145: The marketing manager for an automobile manufacturer

Q183: Referring to Table 12-7,the test will involve

Q184: Referring to Table 11-4,based on the Tukey-Kramer

Q195: Referring to Table 10-14,what is the largest