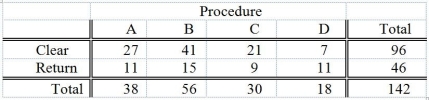

TABLE 12-5

Four surgical procedures currently are used to install pacemakers. If the patient does not need to return for follow-up surgery, the operation is called a "clear" operation. A heart center wants to compare the proportion of clear operations for the 4 procedures and collects the following numbers of patients from their own records:

They will use this information to test for a difference among the proportion of clear operations using a chi-square test with a level of significance of 0.05.

-Referring to Table 12-5, there is sufficient evidence to conclude that the proportions between procedure A and procedure C are different at a 0.05 level of significance.

Definitions:

Intra-entity Transactions

Transactions that take place between two divisions or units within the same company, affecting only internal accounts.

Accrual-based Income

A method of accounting that records revenue when it is earned and expenses when they are incurred, regardless of when cash is received or paid.

Tax Rate

The percentage at which an individual or corporation is taxed by the government.

Deferred Income Taxes

Taxes applicable to income that are due in the future periods due to temporary differences between the tax base of assets or liabilities and their carrying amount in the financial statements.

Q51: Referring to Table 12-5,the overall or mean

Q54: Referring to Table 12-7,there is sufficient evidence

Q55: When testing H₀: π₁ - π₂ =

Q71: Referring to Table 13-11,the null hypothesis that

Q87: Referring to Table 12-5,the test will involve

Q99: Referring to Table 11-12,the mean square for

Q105: Referring to Table 13-9,to test the claim

Q108: Referring to Table 11-10,the within (error)degrees of

Q118: Referring to Table 11-3,the among group variation

Q174: Referring to Table 12-11,the decision made suggests