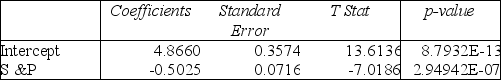

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the appropriate null and alternative hypotheses are, respectively,

Definitions:

Personal Moral Principles

A set of values and ethical standards that an individual holds as guides for their behavior and decision-making.

Law and Order

A phrase referring to the strict enforcement of laws and the maintenance of public order and safety.

Authoritative Pattern

A parenting style marked by high demands but also high responsiveness, leading to well-adjusted children.

Parenting

The actions and practices involved in raising and nurturing children from infancy through adulthood.

Q45: Referring to Table 11-5,the value of MSA

Q111: Referring to Table 12-16,the p-value of the

Q118: Referring to Table 12-3,the expected cell frequency

Q150: Referring to Table 11-8,what are the degrees

Q150: The Kruskal-Wallis test is an extension of

Q161: The coefficient of determination represents the ratio

Q162: Referring to Table 13-2,what is the coefficient

Q199: Referring to Table 13-10,construct a 95% confidence

Q238: Referring to 14-16,what is the value of

Q264: Referring to Table 14-5,one company in the