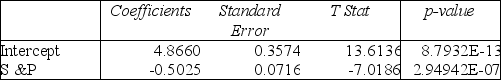

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the p-value of the associated test statistic is

Definitions:

Holistic Thinking

A cognitive approach focusing on the whole rather than its constituent parts, and understanding systems or phenomena as integrated wholes.

Relational Thinking

A cognitive process that involves identifying connections and relationships between objects, ideas, or situations.

Dialectical Thinking

A method of thought that involves holding two opposing points of view in mind at the same time to reach a synthesis or integration of the two.

Categorical Thinking

A cognitive process that involves organizing information into categories for easier understanding and decision-making, sometimes at the expense of recognizing unique or nuanced differences.

Q13: Referring to Table 12-8,the calculated test statistic

Q37: Referring to Table 11-6,what is the value

Q56: Referring to Table 11-7,what are the degrees

Q70: Referring to Table 13-4,the managers of the

Q77: Referring to Table 11-7,what are the degrees

Q109: Referring to Table 13-4,suppose the managers of

Q145: Referring to Table 11-6,what is the p-value

Q157: In testing a hypothesis using the X²

Q157: Referring to Table 11-5,the among-group variation or

Q221: The slopes in a multiple regression model