TABLE 14-18

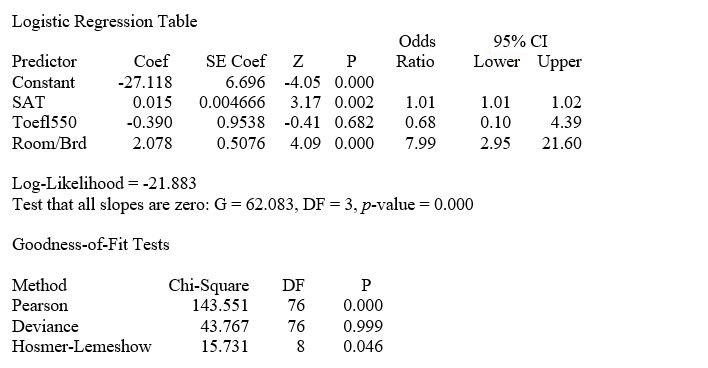

A logistic regression model was estimated in order to predict the probability that a randomly chosen university or college would be a private university using information on mean total Scholastic Aptitude Test score (SAT) at the university or college, the room and board expense measured in thousands of dollars (Room/Brd), and whether the TOEFL criterion is at least 550 (Toefl550 = 1 if yes, 0 otherwise.) The dependent variable, Y, is school type (Type = 1 if private and 0 otherwise).

The Minitab output is given below:

-Referring to Table 14-18, what is the p-value of the test statistic when testing whether Toefl500 makes a significant contribution to the model in the presence of the other independent variables?

Definitions:

Borrowing Risk

The potential danger that borrowers might not be able to repay their loans or meet other financial obligations, leading to financial loss for the lender.

Accrued Interest

Interest that has been incurred but not yet paid at the end of a period.

Adjusting Entry

An accounting record made to update the financial statements to reflect transactions that have occurred but are not yet recorded.

Interest Expense

The cost incurred by an entity for borrowed funds, usually presented as an expense in the income statement.

Q4: Referring to Table 15-2,is the overall model

Q10: Referring to Table 15-3,suppose the chemist decides

Q20: Referring to Table 17-2,what is the numerical

Q45: C<sub>p</sub> > 1 indicates that if the

Q48: The Shewhart-Deming cycle plays an important role

Q77: In a particular model,the sum of the

Q95: Referring to Table 16-12,to obtain a forecast

Q111: What do we mean when we say

Q248: Referring to Table 14-8,the analyst wants to

Q298: Referring to Table 14-19,what is the p-value