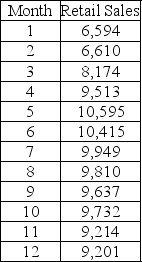

TABLE 16-13

Given below is the monthly time-series data for U.S. retail sales of building materials over a specific year.

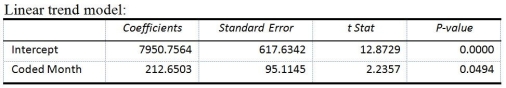

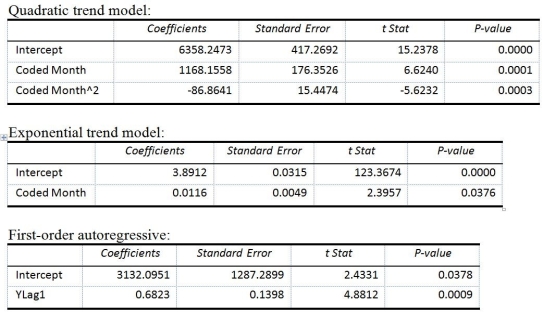

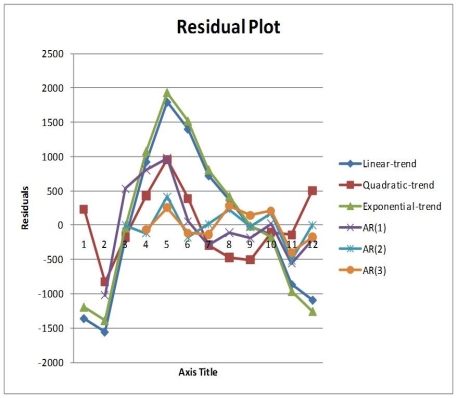

The results of the linear trend, quadratic trend, exponential trend, first-order autoregressive, second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the first month is 0:

-Referring to Table 16-13, what is the exponentially smoothed forecast for the 13ᵗʰ month using a smoothing coefficient of W = 0.5 if the exponentially smooth value for the 10ᵗʰ and 11ᵗʰ month are 9,746.3672 and 9,480.1836, respectively?

Definitions:

Coupon Rate

Each year, the interest yield on a bond is expressed as a percentage of its nominal value.

Market Rate of Interest

The prevailing rate at which borrowers and lenders agree to transact, influenced by various economic factors.

Bond

A fixed income instrument representing a loan made by an investor to a borrower, typically corporate or governmental.

Issued

Refers to securities or other financial instruments that have been created and offered for sale to investors.

Q2: Referring to Table 17-1,what is the numerical

Q18: Referring to Table 19-1,the opportunity loss for

Q23: As a general rule,one can use the

Q25: Referring to Table 7-2,what proportion of the

Q26: A sample of 200 students at a

Q77: Referring to Table 17-3,suppose the analyst constructs

Q88: Referring to Table 14-8,the predicted salary for

Q89: Referring to 14-16,_ of the variation in

Q108: Referring to Table 16-11,using the first-order model,the

Q264: Referring to Table 19-2,the expected profit under