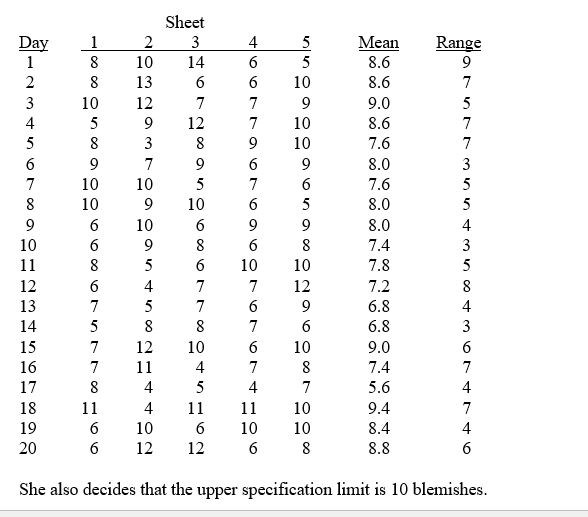

TABLE 17-7

A supplier of silicone sheets for producers of computer chips wants to evaluate her manufacturing process.She takes samples of size 5 from each day's output and counts the number of blemishes on each silicone sheet.The results from 20 days of such evaluations are presented below.

-Referring to Table 17-7,construct an  chart for the number of blemishes.

chart for the number of blemishes.

Definitions:

Taxable Income

The amount of income that is used to calculate an individual's or a company's income tax dues, calculated as gross income minus deductions and exemptions.

Pre-tax Book Income

The income of a company calculated before any tax is applied, based on accounting principles rather than tax laws.

Deferred Tax Liability

A tax obligation that is recorded on the balance sheet due to temporary timing differences in recognizing revenue and expenses for accounting and tax purposes.

Capital Expenditures

Capital allocated by an enterprise for the purchase, improvement, and upkeep of tangible assets like land, factories, or machinery.

Q6: Referring to Table 17-3,suppose the sample mean

Q8: Referring to Table 16-4,exponential smoothing with a

Q17: The R chart is a control chart

Q42: Referring to Table 16-5,the number of arrivals

Q52: Referring to Table 17-6,a p control chart

Q108: Referring to Table 14-18,what is the estimated

Q126: You need to decide whether you should

Q272: Referring to Table 14-18,there is not enough

Q276: Referring to Table 12-1,what is the value

Q314: Referring to Table 19-2,what is the optimal