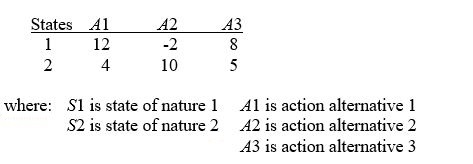

TABLE 19-1

The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.

-Referring to Table 19-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected opportunity loss (EOL) for A1 is

Definitions:

Total Current Assets

The sum of all assets likely to be converted into cash within a year, including cash, marketable securities, accounts receivable, and inventory.

Total Current Liabilities

These are obligations that a company is required to pay within one year or within the normal operating cycle.

Working Capital

The variance between a business's immediate assets and its short-term obligations, signalling its ability to meet short-term debts.

Current Ratio

A financial liquidity ratio that compares a company's current assets to its current liabilities.

Q38: The _ is the interest rate that

Q47: Lisa lives out in the country with

Q49: Referring to Table 9-3,if you select a

Q55: A(n) _ is a value that the

Q62: A single-sampling plan by attributes is needed

Q92: The snap-back method of time study resets

Q131: Referring to Table 16-8,the forecast for profits

Q178: Referring to Table 9-1,if you select a

Q213: Referring to Table 19-5,what is the expected

Q297: Referring to Table 19-5,what is the optimal