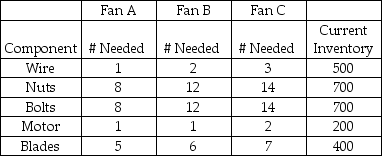

Belsky Manufacturing makes three models of fans, identified by the unimaginative names of A, B, and C. The fans are made out of nuts, bolts, wire, blades, and motors. The current inventory levels and parts list for each type of fan is shown in the table.

Fan A sells for $18, Fan B sells for $25, and Fan C sells for $30.

Milo Belsky decided to arrive at an optimal production quantity using linear programming. His initial solution was to produce 50 Fan As and 21.4 Fan Cs for a profit of $1,542.86.

Determine what his inventory would be.

Charlie Belsky made an important change to the model and ran the linear programming software again, His solution was to produce 50 Fan As, -150 Fan Bs, and 150 Fan Cs for a profit of $1,650 units. What change did he make to the model and what would the ending inventory be if they were to produce according to this plan? What are the practical implications of this solution?

Definitions:

WACC

Weighted Average Cost of Capital, a calculation of a firm's cost of capital in which each category of capital is proportionately weighted, used to determine the rate of return a company must earn on its existing assets to satisfy its creditors, owners, and other providers of capital.

Low Risk Projects

Investments or projects that are considered to have a lower probability of resulting in a financial loss.

Investor Risk Aversion

The tendency of investors to prefer lower-risk investments to avoid potential losses.

WACC

Weighted Average Cost of Capital, a calculation of a firm's cost of capital in which each category of capital is proportionately weighted.

Q1: An automatic, one-lane, drive-through car wash is

Q6: Refer to the instruction above. What volume

Q7: _ is the cash that will flow

Q12: Sometimes referred to as the world champion,

Q30: Using the information in Case I.1, what

Q55: What is a finite-source model? Give an

Q62: Referring to Table 19-1,if the probability of

Q75: The standard time for a work element

Q92: The snap-back method of time study resets

Q116: Using the information in Table J.11 and