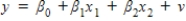

If the model  satisfies the first four Gauss-Markov assumptions, then v has:

satisfies the first four Gauss-Markov assumptions, then v has:

Definitions:

Semiannual Interest

Interest that is calculated and paid twice a year, often on a bond or loan.

Bond Premium

The amount by which the market price of a bond exceeds its face value, usually occurring when the bond's interest rate is higher than the current market rate.

Straight-line Method

An accounting method of depreciating fixed assets where the asset's cost is evenly distributed over its useful life to allocate the expense of the asset over its lifespan.

Earnings Per Share

A measure of a company's profitability, calculated as net income divided by the number of outstanding shares.

Q3: The variance of a random walk process

Q4: In a random effects model, we assume

Q10: The principle of finance that "reputation matters"

Q20: An auxiliary regression refers to a regression

Q26: In a natural experiment, the same cross-sectional

Q33: The six principles of finance include all

Q68: Who is likely to have the most

Q83: The health of centenarians is such that

Q83: Reminiscence can help adults in managing life

Q119: Involves analyzing individual client insurance needs and