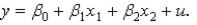

Suppose the variable x2 has been omitted from the following regression equation,

is the estimator obtained when

is the estimator obtained when  is omitted from the equation. The bias in

is omitted from the equation. The bias in  is positive if _____.

is positive if _____.

Definitions:

Risky

Involves a high degree of uncertainty and potential for loss in relation to an investment or decision.

Average Return

The simple mathematical average of a series of returns generated over a period of time.

Standard Deviations

A statistical measure of the dispersion or variability in a data set, often used in finance to represent the volatility or risk of an investment.

Asset Classes

Categories of assets, such as stocks, bonds, real estate, and commodities, that exhibit different characteristics, behaviors, and risk profiles.

Q9: When a series has the same average

Q14: Which of the following is true?<br>A)In ordinary

Q20: In the regression of y on x,

Q25: An economist wants to study the effect

Q38: Dementia-like symptoms such as problems with attention

Q47: Omar is 74 years old, lives independently,

Q60: More physically fit and active older adults

Q79: Beverly is spending less time with her

Q144: Successful elders retain a sense that they

Q154: The frequency of sexual activity increases with