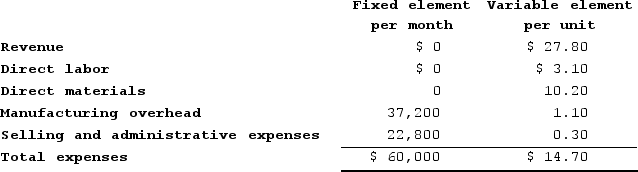

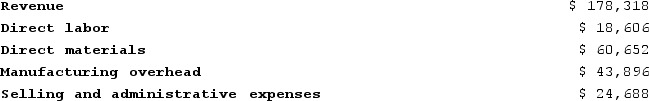

Trevorrow Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During June, the company budgeted for 6,200 units, but its actual level of activity was 6,160 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June:Data used in budgeting:  Actual results for June:

Actual results for June: The activity variance for net operating income in June would be closest to:

The activity variance for net operating income in June would be closest to:

Definitions:

Variable Costing

A costing method where only variable production costs are included in product costs, with fixed overhead expenses treated as period costs.

Contribution Format

A method of income statement presentation that separates fixed costs from variable costs to highlight the contribution margin.

Reconciliation Method

A process used in accounting to ensure that two sets of records (usually the balances of two accounts) are in agreement.

Absorption Costing

A calculation method for product pricing that includes all components of manufacturing costs—direct materials, direct labor, both variable and fixed overheads— into the product's overall cost.

Q12: Bartosiewicz Clinic uses client-visits as its measure

Q25: Which procedure may increase the likelihood of

Q96: Each time 3-year-old Maddy uses her potty

Q106: The following information relates to Mapfes Manufacturing

Q108: Throughout the lifespan physical, cognitive, and socioemotional

Q233: Paulis Kennel uses tenant-days as its measure

Q257: Prowse Corporation is an oil well service

Q322: Bruer Jeep Tours operates jeep tours in

Q344: Neighbors Kennel uses tenant-days as its measure

Q479: Hubbard Kennel uses tenant-days as its measure