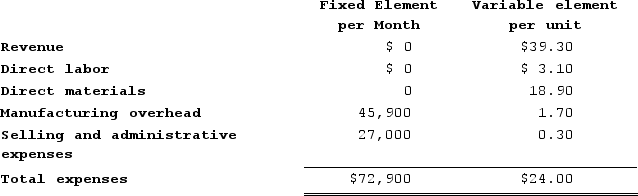

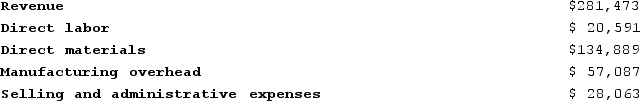

Kekiwi Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During January, the company budgeted for 6,900 units, but its actual level of activity was 6,910 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for January:Data used in budgeting:  Actual results for January:

Actual results for January: The net operating income in the flexible budget for January would be closest to:

The net operating income in the flexible budget for January would be closest to:

Definitions:

Tax Law

The body of laws and regulations governing the administration and enforcement of tax duties on individuals, corporations, and other entities.

Charitable Contributions

Donations made to qualified organizations, which can often be deducted from taxable income.

Taxable Income

The portion of one's income that is subject to taxes by federal, state, and/or local governments, calculated after deductions and exemptions.

Carryforward

A tax provision allowing current losses or credits to be used in future tax years to offset potential gains or income.

Q18: Genetic counseling is recommended for couples from

Q30: Piechocki Corporation manufactures and sells a single

Q53: Professor Kahn is an expert in behavior

Q88: _ development is characterized by slow and

Q93: Catano Corporation pays for 40% of its

Q141: Which practice reduced mother-to-child HIV transmission during

Q165: Pratte Boat Wash's cost formula for its

Q343: Kaina Clinic uses client-visits as its measure

Q424: A favorable spending variance occurs when the

Q482: Tomlison Corporation manufactures and sells a single