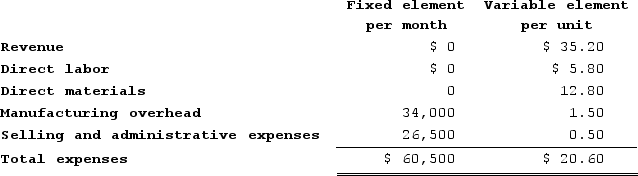

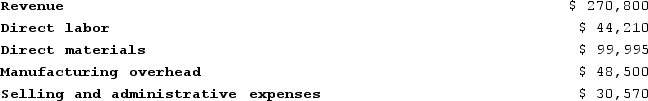

Piechocki Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During May, the company budgeted for 7,700 units, but its actual level of activity was 7,650 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for May: Data used in budgeting: Actual results for May:

Actual results for May: The activity variance for direct labor in May would be closest to:

The activity variance for direct labor in May would be closest to:

Definitions:

Downside Exposure

The potential loss in value of an investment due to market declines, highlighting the risk in bearish scenarios.

VaR (Value At Risk)

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over a specific time frame.

Returns

The profit or loss generated on an investment over a specific period, usually expressed as a percentage.

Sharpe Measure

A ratio used to evaluate the risk-adjusted return of an investment, calculated by subtracting the risk-free rate from the return of the investment and dividing by the investment's standard deviation.

Q14: Petrini Corporation makes one product and it

Q36: Luckman Corporation bases its budgets on the

Q53: Bartosiewicz Clinic uses client-visits as its measure

Q86: The selling and administrative budget is typically

Q136: A particularly important finding associated with the

Q173: Budgeted sales in Acer Corporation over the

Q178: Klingshirn Corporation is a service company that

Q196: Dure Corporation's cost formula for its selling

Q237: Leist Clinic uses client-visits as its measure

Q487: Knapper Kennel uses tenant-days as its measure