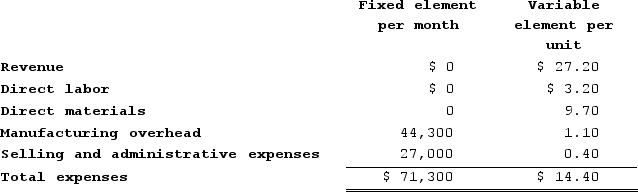

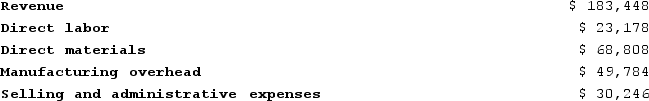

Neeb Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During January, the company budgeted for 7,000 units, but its actual level of activity was 7,040 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for January:Data used in budgeting:  Actual results for January:

Actual results for January: The direct labor in the planning budget for January would be closest to:

The direct labor in the planning budget for January would be closest to:

Definitions:

Dividends Payable

liabilities representing the amount of dividends declared by a company's board but not yet paid to shareholders.

Accounts Payable

Money owed by a company to its creditors for goods and services that have been received but not yet paid for.

Accrual Basis

An accounting method where revenues and expenses are recorded when they are earned or incurred, regardless of when cash transactions happen.

Cash Basis

An accounting method where revenues and expenses are recognized when cash is received or paid, rather than when earned or incurred.

Q8: Rokosz Corporation makes one product and it

Q18: Lawes Corporation manufactures and sells a single

Q27: Noninvasive prenatal testing is without risk to

Q73: When preparing a direct materials budget, the

Q122: Fager Clinic uses client-visits as its measure

Q184: Sunn Corporation manufactures and sells a single

Q254: The LaGrange Corporation had the following budgeted

Q293: Hubbard Kennel uses tenant-days as its measure

Q385: Dinham Kennel uses tenant-days as its measure

Q446: Standahl Air uses two measures of activity,