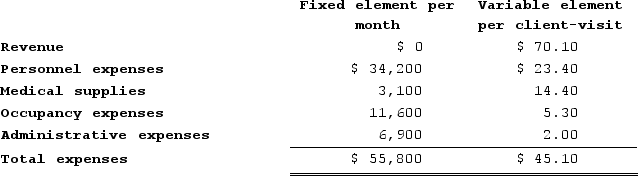

Fager Clinic uses client-visits as its measure of activity. During February, the clinic budgeted for 2,390 client-visits, but its actual level of activity was 2,440 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for February:Data used in budgeting:  Actual results for February:

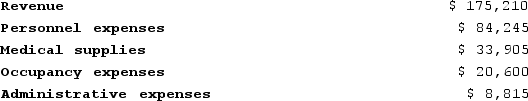

Actual results for February: The revenue variance for February would be closest to:

The revenue variance for February would be closest to:

Definitions:

LIFO Inventory

LIFO inventory is a method of inventory valuation where the most recently produced or purchased items are recorded as sold first, potentially reducing taxes in periods of inflation.

Sales Exceed Production

A situation where the demand for a company's products surpasses its current production capacity or available inventory.

Variable Costing

An accounting method that only includes variable costs—costs that vary with production levels—when calculating the cost of producing a good or service.

Net Operating Income

The profit generated from a company’s everyday business operations, calculated by subtracting operating expenses from revenue.

Q19: Hesterman Corporation makes one product and has

Q27: The following information was taken from the

Q67: Which data collection method is the most

Q94: Dilly Farm Supply is located in a

Q128: Davis Corporation is preparing its Manufacturing Overhead

Q191: Sarafiny Corporation is in the process of

Q292: Kawamura Kennel uses tenant-days as its measure

Q337: Wagster Urban Diner is a charity supported

Q415: Rameriz Corporation is a shipping container refurbishment

Q464: Stegemann Corporation is a shipping container refurbishment