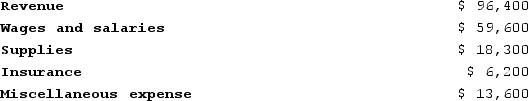

Ocean Corporation uses customers served as its measure of activity. During June, the company budgeted for 21,000 customers, but actually served 19,000 customers. The company bases its budgets on the following information: Revenue should be $5.00 per customer served. Wages and salaries should be $24,900 per month plus $1.80 per customer served. Supplies should be $0.90 per customer served. Insurance should be $6,500 per month. Miscellaneous expenses should be $3,500 per month plus $0.40 per customer served. The company reported the following actual results for June:

Required:Prepare the company's flexible budget performance report for June. Label each variance as favorable (F) or unfavorable (U).

Required:Prepare the company's flexible budget performance report for June. Label each variance as favorable (F) or unfavorable (U).

Definitions:

Cost of Debt

The effective interest rate a company pays on its debts, including bonds, loans, and lines of credit.

Lenders' Return

The profit or interest earned by lenders for providing funds to borrowers, reflecting the compensation for the risk of lending and the time value of money.

Equity Investment

A financial contribution into shares of a company, granting the investor ownership rights and potential profit shares.

WACC

The Weighted Average Cost of Capital, a calculation of a firm's capital cost that weighs each category of capital (equity, debt, etc.) proportionally.

Q57: Which of the following statements is NOT

Q89: Millner Corporation has provided the following data

Q159: Paparo Corporation has provided the following data

Q178: Tracie Corporation manufactures and sells women's skirts.

Q232: Bustillo Incorporated is working on its cash

Q238: Avril Incorporated bases its manufacturing overhead budget

Q278: Leist Clinic uses client-visits as its measure

Q313: Guareno Clinic uses client-visits as its measure

Q434: Quesnel Clinic bases its budgets on the

Q448: Piechocki Corporation manufactures and sells a single