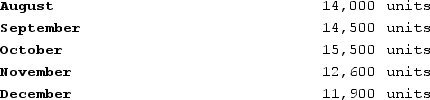

Coles Corporation, Incorporated makes and sells a single product, Product R. Three yards of Material K are needed to make one unit of Product R. Budgeted production of Product R for the next five months is as follows:  The company wants to maintain monthly ending inventories of Material K equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 2,500 yards of Material K were on hand. The cost of Material K is $0.85 per yard. The company wants to prepare a Direct Materials Purchase Budget for the rest of the year.The total cost of Material K to be purchased in August is:

The company wants to maintain monthly ending inventories of Material K equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 2,500 yards of Material K were on hand. The cost of Material K is $0.85 per yard. The company wants to prepare a Direct Materials Purchase Budget for the rest of the year.The total cost of Material K to be purchased in August is:

Definitions:

Absorption Costing

A method of inventory costing in which all costs of production (both fixed and variable) are treated as product costs.

Gross Margin

Gross margin is the difference between revenue and the cost of goods sold, divided by revenue, expressed as a percentage. It measures how much a company earns taking into consideration the costs that it incurs for producing its products or services.

Variable Costing

An accounting method that includes only variable costs—costs that change with production levels—in the calculation of cost of goods sold and excludes fixed costs.

Net Operating Income

The total earnings from a company's operations after deducting operating expenses but before interest and taxes.

Q4: Managing and sustaining product diversity requires many

Q63: Weller Industrial Gas Corporation supplies acetylene and

Q72: Hesterman Corporation makes one product and has

Q104: Fager Clinic uses client-visits as its measure

Q199: Petrini Corporation makes one product and it

Q213: Desjarlais Corporation uses the following activity rates

Q228: Oltz Corporation is conducting a time-driven activity-based

Q296: Brong Corporation is a shipping container refurbishment

Q337: Wagster Urban Diner is a charity supported

Q370: Purchase order processing is an example of