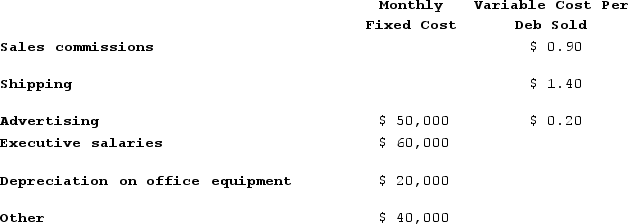

The Puyer Corporation makes and sells only one product called a Deb. The company is in the process of preparing its Selling and Administrative Expense Budget for next year. The following budget data are available:  All of these expenses (except depreciation) are paid in cash in the month they are incurred.If the company has budgeted to sell 16,000 Debs in January, then the total budgeted variable selling and administrative expenses for January will be:

All of these expenses (except depreciation) are paid in cash in the month they are incurred.If the company has budgeted to sell 16,000 Debs in January, then the total budgeted variable selling and administrative expenses for January will be:

Definitions:

Assessed Valuations

The dollar value assigned to a property for purposes of measuring applicable taxes.

Overhead Expenses

Indirect costs related to running a business that are not directly tied to production, including rent, utilities, and administrative salaries.

Assessed Valuation

Assessed Valuation is the dollar value assigned to a property for purposes of taxation by a public authority.

Taxation

The process by which governments impose charges on citizens and corporate entities, generating revenue used to fund public services and infrastructure.

Q9: Cambra Corporation manufactures two products: Product N70E

Q11: Rokosz Corporation makes one product and it

Q35: An activity-based costing system that is designed

Q53: Gendel Corporation is conducting a time-driven activity-based

Q59: Otomo Jeep Tours operates jeep tours in

Q69: Dilly Farm Supply is located in a

Q121: Bustillo Incorporated is working on its cash

Q149: Gauch Corporation is conducting a time-driven activity-based

Q299: Lysiak Corporation uses an activity based costing

Q334: Provenzano Corporation manufactures two products: Product B56Z