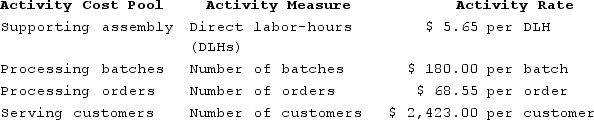

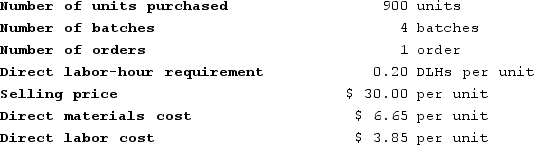

Leber Enterprises makes a variety of products that it sells to other businesses. The company's activity-based costing system has four activity cost pools for assigning costs to products and customers. Details concerning that ABC system are listed below:  The cost of serving customers, $2,423.00 per customer, is the cost of serving a customer for one year. Solecki Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below:

The cost of serving customers, $2,423.00 per customer, is the cost of serving a customer for one year. Solecki Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below: According to the ABC system, the total overhead cost for this customer this past year was closest to:

According to the ABC system, the total overhead cost for this customer this past year was closest to:

Definitions:

Public Accounting Firm

An organization that provides a range of accounting services to the public, including auditing, tax preparation, and consulting services.

Accounting Description

A detailed account or explanation of the nature, features, and implications of an accounting entry or policy.

Economic Activities

Actions that involve the production, distribution, and consumption of goods and services within an economy.

Forensic Accounting

The practice of using accounting skills to investigate fraud or embezzlement and to analyze financial information for use in legal proceedings.

Q29: Carlino Corporation is an oil well service

Q40: Bonkowski Corporation makes one product and has

Q55: Crocetti Corporation makes one product and has

Q100: LBC Corporation makes and sells a product

Q105: Davis Corporation is preparing its Manufacturing Overhead

Q174: Fuson Corporation makes one product and has

Q303: Angara Corporation uses activity-based costing to determine

Q338: Daston Company manufactures two products, Product F

Q365: Lakey Corporation has an activity-based costing system

Q432: Bickel Corporation uses customers served as its