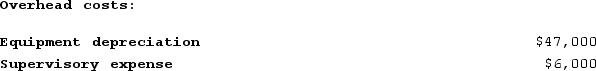

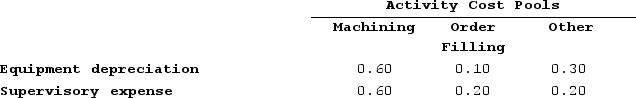

Lysiak Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment depreciation and supervisory expense-are allocated to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

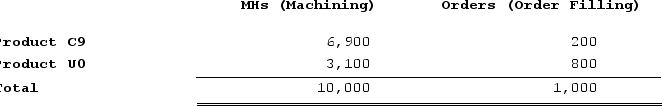

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Intercalated Discs

Intercalated discs are specialized connections between cardiac muscle cells that facilitate the synchronized contraction of the heart.

Cardiac

Pertaining to the heart, its function, or its diseases.

Muscle Cells

Specialized cells designed to contract and cause movement; can be classified as skeletal, cardiac, or smooth muscle cells.

Muscle Fibers

Individual cells of muscles that are long, cylindrical, and capable of contraction to facilitate body movements.

Q19: Choi Corporation is conducting a time-driven activity-based

Q31: Weisgarber Corporation is conducting a time-driven activity-based

Q33: Under absorption costing, a portion of fixed

Q44: The manufacturing overhead budget of Reigle Corporation

Q164: The master budget consists of a number

Q203: Provenzano Corporation manufactures two products: Product B56Z

Q248: Campanaro Corporation is conducting a time-driven activity-based

Q251: Immen Corporation manufactures two products: Product B82O

Q270: Whitmer Corporation is working on its direct

Q354: Mcnamee Corporation's activity-based costing system has three