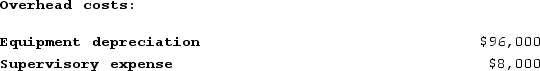

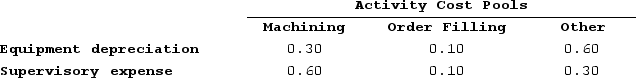

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

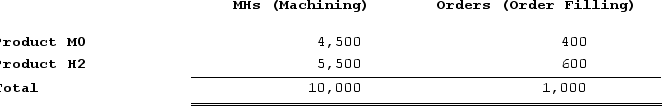

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

Definitions:

Percentage-Of-Completion

An accounting method that recognizes revenues and gross profit on long-term contracts in proportion to the work completed to date.

Gross Profit

The difference between sales revenue and the cost of goods sold, representing the basic profitability of the sales of goods and services.

Construction Costs

Expenses incurred during the process of building structures, infrastructure, or other significant physical assets, including materials, labor, and overhead.

Service Cost

The expense recognized by an employer for the portion of an employee's pension or post-retirement plan earned during the year.

Q140: Sevenbergen Corporation makes one product and has

Q180: The manufacturing overhead budget at Franklyn Corporation

Q187: Roberds Tech is a for-profit vocational school.

Q194: Houseal Corporation has provided the following data

Q224: Salem Corporation is conducting a time-driven activity-based

Q240: In activity-based costing, a product margin may

Q244: When activity-based costing is used for internal

Q320: The impact on net operating income of

Q326: In a Capacity Analysis report in time-based

Q369: Krueger Corporation is conducting a time-driven activity-based