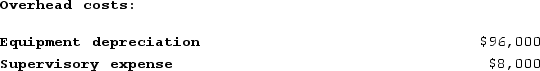

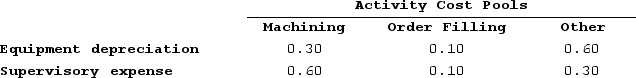

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

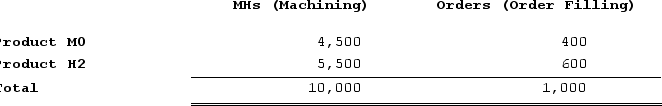

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H2 under activity-based costing?

What is the overhead cost assigned to Product H2 under activity-based costing?

Definitions:

Bonds

Fixed-income securities that represent a loan made by an investor to a borrower, typically corporate or governmental, entitling the holder to interest payments and the return of principal at maturity.

Par Value

The nominal value of a bond or stock as declared by the issuer, which might not correspond with its actual market price.

Profit Margin

A financial metric expressing the percentage of revenue that exceeds the costs of goods sold, indicating the profitability of a company's sales.

Total Asset Turnover

A financial ratio that measures the efficiency of a company's use of its assets in generating sales revenue; it is calculated by dividing sales revenue by total assets.

Q23: Nourse Enterprises makes a variety of products

Q27: The following information was taken from the

Q52: Smidt Corporation has provided the following data

Q134: In the second-stage allocation in activity-based costing,

Q193: Gendel Corporation is conducting a time-driven activity-based

Q225: Pavelko Corporation has provided the following data

Q291: Kern Corporation produces a single product. Selected

Q331: Gabuat Corporation, which has only one product,

Q343: Orick Enterprises makes a variety of products

Q373: Segment margin is sales less variable expenses