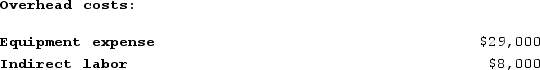

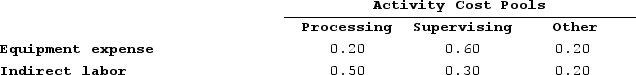

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

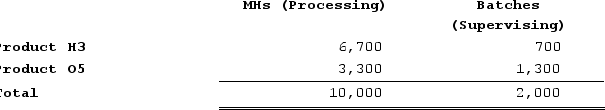

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Deferred

This refers to items or transactions that are postponed or delayed to a future date for accounting purposes.

Percentage-of-Completion Method

An accounting technique used to recognize revenue and expenses of long-term projects proportionally to the work completed to date.

Long-Term Contracts

Agreements that establish the terms for ongoing services or project work that lasts over an extended period, often involving incremental delivery and payment schedules.

Contract Loss

A financial loss encountered in a contract when the total costs exceed the revenue earned from the contract, typically recognized in construction or long-term projects.

Q41: The manufacturing overhead budget at Foshay Corporation

Q44: Absorption costing treats all manufacturing costs as

Q83: Uchimura Corporation has two divisions: the AFE

Q110: Goertz Corporation has an activity-based costing system

Q191: Aaron Corporation, which has only one product,

Q206: The following data have been provided by

Q212: Silver Corporation produces a single product. Last

Q248: Delisa Corporation has two divisions: Division L

Q256: Tat Corporation produces a single product and

Q276: A company produces a single product. Variable