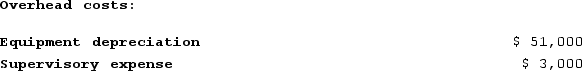

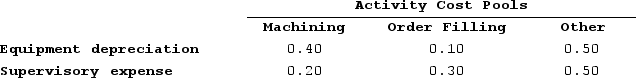

Goertz Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

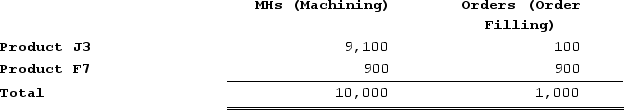

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

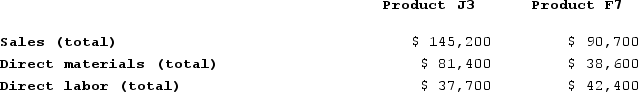

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

Definitions:

Comprehensive Balance Sheet

An extensive version of a balance sheet that includes all financial information and disclosures including those outside the conventional balance sheet.

Assets

Economic resources controlled or owned by a business that are expected to produce benefits in the future.

Liabilities

Financial obligations or debts that a company owes to others, which must be settled over time through the transfer of economic benefits including money, goods, or services.

Classified Balance Sheet

A balance sheet that organizes assets and liabilities into current and long-term categories, helping provide a clearer understanding of a company’s financial position.

Q30: Beamish Incorporated, which produces a single product,

Q44: Absorption costing treats all manufacturing costs as

Q45: Jeanclaude Corporation produces and sells one product.

Q93: Lenart Corporation has provided the following data

Q171: Litzinger Corporation makes one product. The ending

Q209: Tilson Corporation has projected sales and production

Q215: Hadley Corporation, which has only one product,

Q235: All other things the same, if a

Q287: When computing the break even for a

Q350: Carroll Corporation has two products, Q and