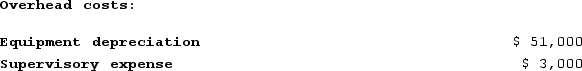

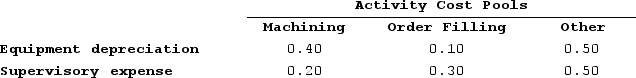

Goertz Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

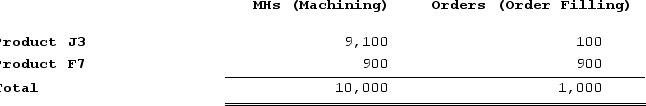

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

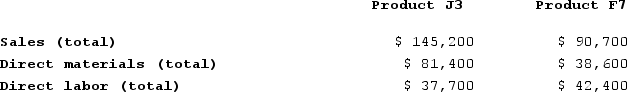

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data: What is the overhead cost assigned to Product F7 under activity-based costing?

What is the overhead cost assigned to Product F7 under activity-based costing?

Definitions:

Manufacturing Overhead Account

An account that tracks indirect production costs such as factory utilities, maintenance, and rent.

Job Costing

A method of costing that assigns expenses to specific jobs or projects.

Direct Labour

The workforce involved directly in manufacturing products or delivering services, whose costs are tied to the production output.

Manufacturing Overhead

Indirect costs associated with manufacturing, such as utilities, maintenance, and factory management salaries.

Q43: Michard Corporation makes one product and it

Q53: Carver Lumber sells lumber and general building

Q68: EMD Corporation manufactures two products, Product S

Q156: Brockney Incorporated bases its manufacturing overhead budget

Q309: Moskowitz Corporation has provided the following data

Q327: Younan Corporation manufactures two products: Product E47F

Q332: Torello Corporation manufactures two products: Product H95V

Q347: Blakesley Corporation is a service company that

Q372: Assuming the LIFO inventory flow assumption, when

Q445: Elvin Hospital bases its budgets on patient-visits.