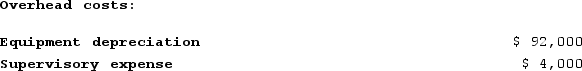

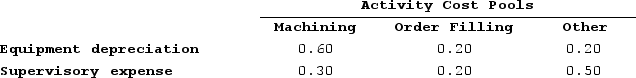

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

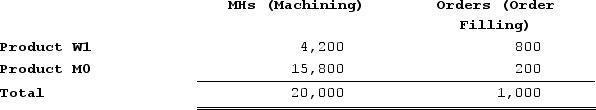

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

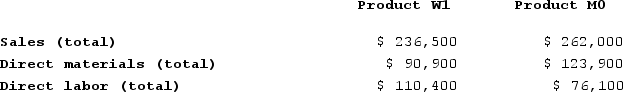

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Cabinet Departments

Major administrative units in the executive branch of the federal government, each headed by a Secretary, responsible for specific areas of government policy.

Regulatory Commissions

Independent agencies of the federal or state government tasked with the regulation of specific economic activities or behaviors, often focusing on industries like telecommunications, utilities, and securities.

Regulation

A set of rules or laws designed to control or govern conduct, typically implemented by a governmental body.

Q7: Data concerning three of the activity cost

Q43: Michard Corporation makes one product and it

Q46: WV Construction has two divisions: Remodeling and

Q79: Bramble Corporation is a small wholesaler of

Q93: Catano Corporation pays for 40% of its

Q176: Weisgarber Corporation is conducting a time-driven activity-based

Q197: Masde Corporation produces and sells Product CharlieD.

Q250: Desilets Corporation has provided the following data

Q304: Aaron Corporation, which has only one product,

Q390: Allocating common fixed costs to segments on