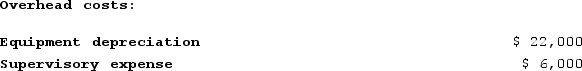

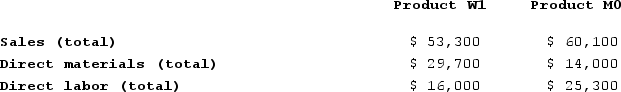

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

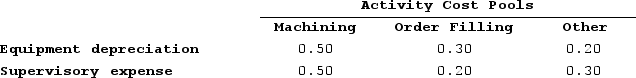

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

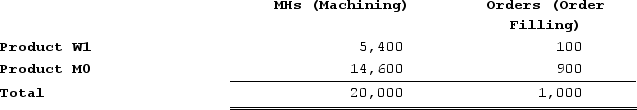

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data: What is the product margin for Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the product margin for Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

Definitions:

Retirement Plan

A financial strategy designed to provide individuals with income or assets to rely on after they have ceased working, often involving savings, investments, and other financial products.

Compounded Semi-annually

This refers to the practice of applying interest to an existing amount plus any accumulated interest twice yearly.

Monthly Mortgage

A regularly scheduled payment which includes principal and interest owed on a mortgage.

Loan Payment

A payment made to reduce the outstanding balance of a loan, often made on a monthly basis.

Q17: One disadvantage of budgeting is that budgeting

Q130: Rossean Tech is a for-profit vocational school.

Q156: Hails Corporation manufactures two products: Product Q21F

Q186: Variable costing is more compatible with cost-volume-profit

Q190: Organization-sustaining activities are carried out regardless of

Q239: Gutknecht Corporation uses an activity-based costing system

Q310: Tubaugh Corporation has two major business segments--East

Q346: Aaron Corporation, which has only one product,

Q351: Departmental overhead rates may not correctly assign

Q373: Roberds Tech is a for-profit vocational school.