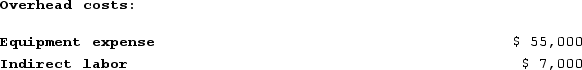

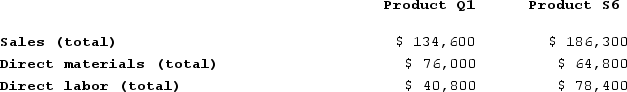

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

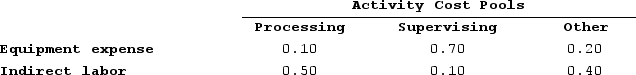

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

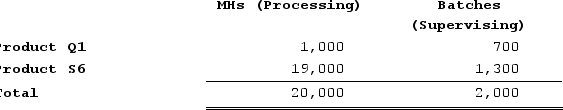

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Grace

An elegance or beauty of form, manner, motion, or action often described in a spiritual or divine context.

Newborn Baby

An infant who is within hours, days, or up to a few weeks from birth.

Electroconvulsive Therapy

A medical treatment for severe mental health disorders involving the application of electrical currents to the brain to induce seizures.

Insulin Therapy

The medical use of insulin, administered through injections or an insulin pump, to manage and regulate blood sugar levels in people with diabetes.

Q46: WV Construction has two divisions: Remodeling and

Q55: Elbrege Corporation manufactures a single product. The

Q83: The LaPann Corporation has obtained the following

Q117: Elerson Corporation is conducting a time-driven activity-based

Q169: Coles Corporation, Incorporated makes and sells a

Q173: The controller of Hendershot Corporation estimates the

Q304: Aaron Corporation, which has only one product,

Q315: Batch-level activities are performed each time a

Q321: Kulka Corporation manufactures two products: Product F82D

Q331: Gabuat Corporation, which has only one product,