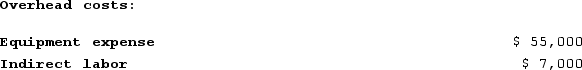

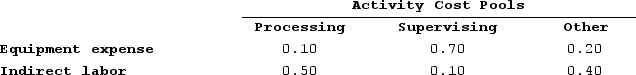

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

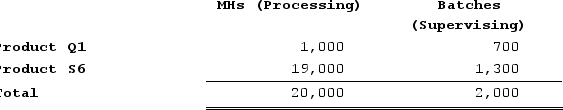

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

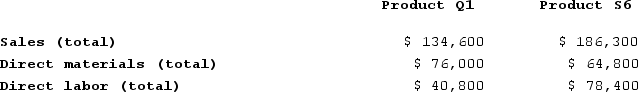

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: What is the overhead cost assigned to Product Q1 under activity-based costing?

What is the overhead cost assigned to Product Q1 under activity-based costing?

Definitions:

Ethical Misconduct

Ethical misconduct involves actions or behaviors by an individual or organization that violate ethical standards or principles.

Ethical Decisions

Choices made based on moral principles and values, considering the rightness and wrongness of potential actions and their impacts.

Unethical Decisions

Choices that go against moral principles and guidelines.

Magnitude of Consequences

The extent or severity of the outcomes resulting from an action or event.

Q17: Wrench Corporation is conducting a time-driven activity-based

Q24: Pierceall Corporation is conducting a time-driven activity-based

Q28: LBC Corporation makes and sells a product

Q99: Petrini Corporation makes one product and it

Q128: In a Capacity Analysis report in time-based

Q146: Bries Corporation is preparing its cash budget

Q210: Kaaua Corporation has provided the following data

Q231: Columbia Corporation produces a single product. The

Q340: Ing Corporation, which has only one product,

Q365: Lakey Corporation has an activity-based costing system