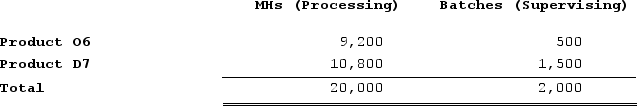

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $27,200; Supervising, $9,300; and Other, $9,500. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Natural Resource

Materials or substances such as minerals, forests, water, and fertile land that occur in nature and can be used for economic gain.

Q56: Roberts Enterprises has budgeted sales in units

Q171: Litzinger Corporation makes one product. The ending

Q242: Tsosie Corporation makes one product and it

Q243: Ferrar Corporation has two major business segments:

Q260: The Puyer Corporation makes and sells only

Q264: Bachrodt Corporation uses activity-based costing to compute

Q323: Heyl Corporation is conducting a time-driven activity-based

Q332: The Southern Corporation manufactures a single product

Q373: Segment margin is sales less variable expenses

Q377: Desjarlais Corporation uses the following activity rates