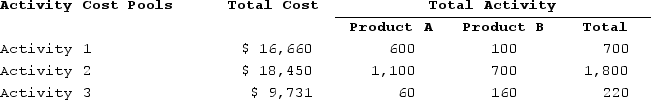

Abel Corporation uses activity-based costing. The company makes two products: Product A and Product B. The annual production and sales of Product A is 200 units and of Product B is 400 units. There are three activity cost pools, with total cost and activity as follows:  The activity rate for Activity 2 is closest to:

The activity rate for Activity 2 is closest to:

Definitions:

Publicly Traded

Refers to a company whose shares are available for purchase by the public on stock exchanges.

Tax Burden

The total amount of taxes paid by an individual or business, expressed as a percentage of income.

Piece Rate Plan

A compensation model where workers are paid a fixed sum for each unit of production completed, rather than an hourly wage.

Teamwork

The collaborative effort of a group to achieve a common goal or complete a task in the most effective and efficient way.

Q5: Caspion Corporation makes and sells a product

Q43: Tustin Corporation has provided the following data

Q69: Dilly Farm Supply is located in a

Q172: Mccrone Corporation has provided the following data

Q237: Perl Corporation uses an activity-based costing system

Q270: Carlton Corporation has two divisions: Delta and

Q356: Machining a part for a product is

Q369: Krueger Corporation is conducting a time-driven activity-based

Q377: Desjarlais Corporation uses the following activity rates

Q379: Angara Corporation uses activity-based costing to determine