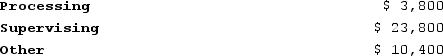

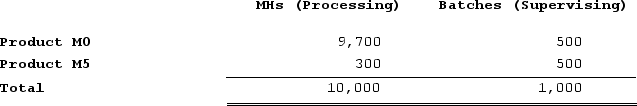

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

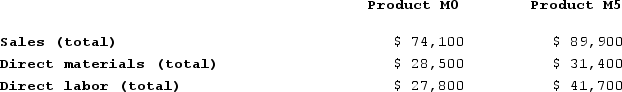

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the product margin for Product M5 under activity-based costing?

What is the product margin for Product M5 under activity-based costing?

Definitions:

Proportional Slice

A proportional slice refers to a segment of a whole, such as in a pie chart, where each slice’s size represents its proportion in relation to the total.

Nominal Data

Data that are categorized into distinct groups and names, without any order or ranking.

Frequency Distribution

A table or graph that displays the frequency of various outcomes in a sample.

Frequency Chart

A graphical representation used to show the frequency of each category or value of data.

Q1: Hagy Corporation has an activity-based costing system

Q2: Meli Corporation manufactures two products: Product L61P

Q57: Which of the following statements is NOT

Q68: EMD Corporation manufactures two products, Product S

Q101: Darke Corporation makes one product and has

Q142: Ploof Corporation is conducting a time-driven activity-based

Q163: Annika Company uses activity-based costing. The company

Q198: Janos Corporation, which has only one product,

Q209: Tilson Corporation has projected sales and production

Q246: Gould Corporation uses the following activity rates