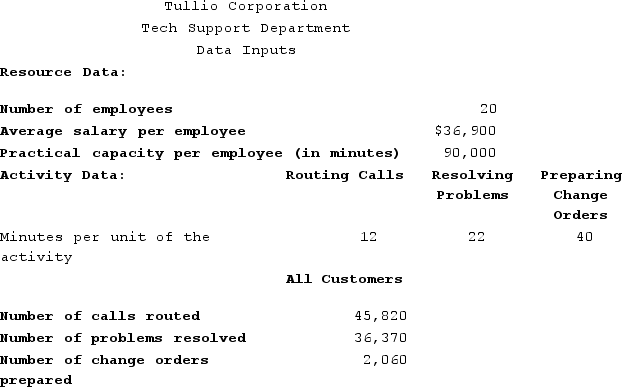

Tullio Corporation is conducting a time-driven activity-based costing study in its Tech Support Department. The company has provided the following data to aid in that study:  On the Capacity Analysis report in time-driven activity-based costing, the "potential adjustment in the number of employees" would be closest to:

On the Capacity Analysis report in time-driven activity-based costing, the "potential adjustment in the number of employees" would be closest to:

Definitions:

Income Taxes Payable

The amount of income taxes that a company has accrued but has not yet paid to the tax authority.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life.

Percentage Depletion

A tax deduction method for accounting natural resource depletion, calculated as a percentage of gross income from the resource.

Product Warranty Costs

Expenses associated with repairing or replacing products under warranty, reflecting the cost of product guarantees to customers.

Q13: Miller Corporation produces a single product. The

Q40: Bonkowski Corporation makes one product and has

Q55: Elbrege Corporation manufactures a single product. The

Q111: Miscavage Corporation has two divisions: the Beta

Q188: The selling and administrative expense budget of

Q243: Ferrar Corporation has two major business segments:

Q290: Rhea Corporation has provided the following data

Q294: Abel Corporation uses activity-based costing. The company

Q308: Segmented statements for internal use should not

Q334: Bellue Incorporated manufactures a single product. Variable