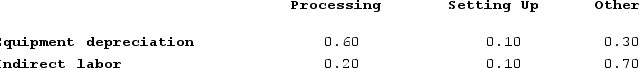

Moorman Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $53,000 and indirect labor totals $3,000. Data concerning the distribution of resource consumption across activity cost pools appear below:

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Constables

Law enforcement officers, typically in a particular jurisdiction, with various duties including serving legal documents and maintaining public order.

Instructions

Detailed information telling how something should be done, operated, or assembled.

Day-To-Day Problems

Challenges or difficulties that individuals encounter in their daily lives, ranging from minor inconveniences to more substantial obstacles.

Officer Role

The specific duties and responsibilities assigned to an individual within a police or military organization.

Q30: Beamish Incorporated, which produces a single product,

Q62: Petrini Corporation makes one product and it

Q140: Chuong Corporation is conducting a time-driven activity-based

Q145: Jahnel Corporation is conducting a time-driven activity-based

Q174: Fuson Corporation makes one product and has

Q177: Last year, Kirsten Corporation's variable costing net

Q211: Spillett Corporation is conducting a time-driven activity-based

Q219: Dilly Farm Supply is located in a

Q297: Choi Corporation is conducting a time-driven activity-based

Q331: Gabuat Corporation, which has only one product,