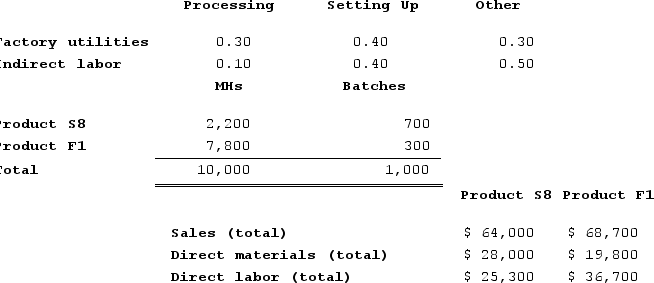

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Definitions:

Nonparticipating

A term often used in insurance to describe a policy that does not grant the holder the rights to share in the insurer's surplus or dividends.

Paid-In Capital

the amount of money that a company receives from issuing stock to investors, reflecting the capital invested by shareholders.

Fair Market Value

The price at which property would sell on the open market between a willing buyer and a willing seller.

Noncumulative Nonparticipating

Refers to a type of preferred stock that does not allow for the accumulation of unpaid dividends if they are not declared by the board, nor does it participate in the extra profits of the company.

Q25: Doede Corporation uses activity-based costing to compute

Q40: Foster Florist specializes in large floral bouquets

Q83: Time-based activity-based costing does not require extensive

Q84: Mossfeet Shoe Corporation is a single product

Q113: Dukelow Corporation has two divisions: the Governmental

Q115: Wolanski Corporation has provided the following data

Q171: In a Cost Analysis report in time-based

Q175: The Dorset Corporation produces and sells a

Q182: Neelon Corporation has two divisions: Southern Division

Q340: Monfort Corporation is conducting a time-driven activity-based