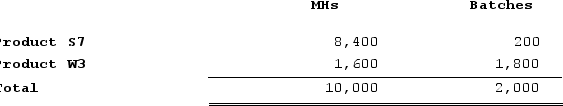

Lakey Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $11,000 for the Machining cost pool, $26,200 for the Setting Up cost pool, and $9,800 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Definitions:

Single-Step Format

In accounting, a method of income statement preparation where expenses are subtracted from revenues in a single step to calculate net income.

Pretax Income

The income earned by a business before tax is deducted.

Extraordinary Loss

A loss resulting from events that are both unusual and infrequent in nature, not expected to recur in the foreseeable future.

Extraordinary Items

Events and transactions that are distinguished by their unusual nature and infrequency, reported separately in financial statements for clearer analysis.

Q20: The Charade Corporation is preparing its Manufacturing

Q39: Krepps Corporation produces a single product. Last

Q91: Norenberg Corporation manufactures a single product. The

Q94: Moskowitz Corporation has provided the following data

Q120: The Charade Corporation is preparing its Manufacturing

Q178: Krepps Corporation produces a single product. Last

Q180: Wedd Corporation uses activity-based costing to assign

Q207: Delisa Corporation has two divisions: Division L

Q310: Tubaugh Corporation has two major business segments--East

Q334: Provenzano Corporation manufactures two products: Product B56Z