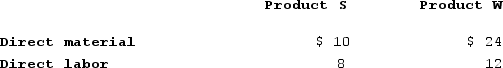

EMD Corporation manufactures two products, Product S and Product W. Product W is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product W. Product W is the more complex of the two products, requiring one hour of direct labor time per unit to manufacture compared to one-half hour of direct labor time for Product S. Product W is produced on an automated production line.Overhead is currently assigned to the products on the basis of direct-labor-hours. The company estimated it would incur $500,000 in manufacturing overhead costs and produce 10,000 units of Product W and 60,000 units of Product S during the current year. Unit cost for materials and direct labor are:

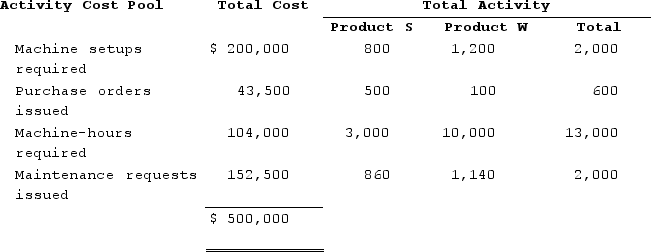

Required:a. Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b. The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Required:a. Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.b. The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Definitions:

FICA Tax

A U.S. federal payroll tax that funds Social Security and Medicare, contributions are made by both employees and employers.

Burden Falls

An economic term referring to how the costs or economic burdens of a policy, tax, or regulation are distributed among various stakeholders.

Elastic

Elastic, in economics, refers to a situation where the quantity demanded or supplied of a good or service significantly changes in response to changes in price.

Inelastic

A characteristic of a good or service whose demand doesn't significantly change when its price changes.

Q16: Hayworth Corporation has just segmented last year's

Q34: The manufacturing overhead budget at Polich Corporation

Q68: Nurre Corporation manufactures and sells one product.

Q88: A decrease in the number of units

Q132: Dallavalle Corporation manufactures and sells one product.

Q151: The Carlsbad Corporation produces and markets two

Q171: Aaron Corporation, which has only one product,

Q193: Tremble Corporation manufactures and sells one product.

Q269: Pacheo Corporation, which has only one product,

Q308: Segmented statements for internal use should not