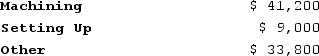

Greife Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

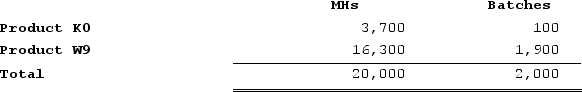

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

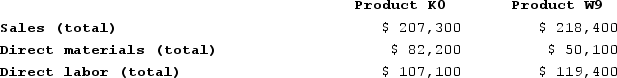

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Definitions:

Net Operating Income

A measure of a company's profitability from its regular business operations, excluding expenses and revenues from non-operational activities.

Gross Margin

The difference between the sales and the cost of goods sold, which shows the profitability before deducting operational expenses.

Average Sale Period

The average time it takes for a company to complete a sale, from initiating contact with a client to closing the deal.

Cost of Goods Sold

Direct financial responsibilities stemming from the fabrication of goods a company sells, incorporating materials and labor.

Q81: Luchini Corporation makes one product and it

Q154: Corbel Corporation has two divisions: Division A

Q169: Coles Corporation, Incorporated makes and sells a

Q214: Departmental overhead rates will correctly assign overhead

Q222: Villella Corporation is conducting a time-driven activity-based

Q294: A company produces a single product. Variable

Q304: Lindenmuth Corporation is conducting a time-driven activity-based

Q331: The degree of operating leverage in a

Q333: Clouthier Corporation has two divisions: Home Division

Q372: Assuming the LIFO inventory flow assumption, when