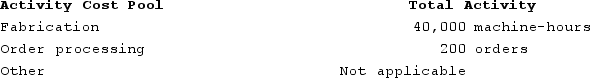

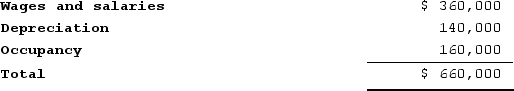

Leaper Corporation uses an activity-based costing system with the following three activity cost pools:  The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs.The company has provided the following data concerning its costs:

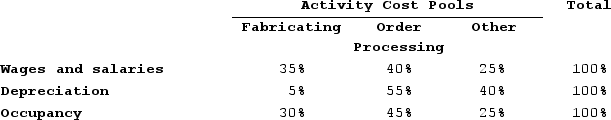

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs.The company has provided the following data concerning its costs: The distribution of resource consumption across activity cost pools is given below:

The distribution of resource consumption across activity cost pools is given below: The activity rate for the Order Processing activity cost pool is closest to:

The activity rate for the Order Processing activity cost pool is closest to:

Definitions:

Overhead Rate

A measure used in cost accounting to allocate overhead costs to produced units, typically expressed as a percentage or a ratio.

Predetermined Overhead Rate

A rate calculated before the period begins, used to allocate manufacturing overhead costs to individual units of production based on a specific activity base.

Direct Labor Costs

Expenses related to employees who are directly involved in the production of goods or services, as opposed to administrative or managerial staff.

Factory Overhead

Indirect costs associated with manufacturing, including utilities, maintenance, and salaries of supervisors, not directly involved in production.

Q13: Lemaire Corporation is conducting a time-driven activity-based

Q63: Weller Industrial Gas Corporation supplies acetylene and

Q96: Meester Corporation has an activity-based costing system

Q120: Bracken Clinic uses client-visits as its measure

Q132: Torello Corporation manufactures two products: Product H95V

Q215: Which of the following budgets are prepared

Q235: Production order processing is an example of

Q263: The salary paid to a store manager

Q288: Teel Printing uses two measures of activity,

Q317: Rients Corporation is a service company that