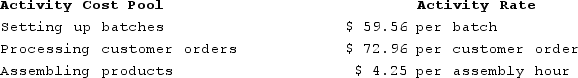

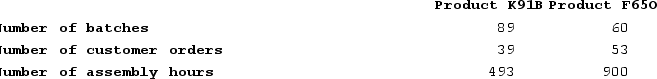

Gould Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data concerning two products appear below:

Data concerning two products appear below: How much overhead cost would be assigned to Product K91B using the activity-based costing system? (Round your intermediate calculations and final answers to 2 decimal places.)

How much overhead cost would be assigned to Product K91B using the activity-based costing system? (Round your intermediate calculations and final answers to 2 decimal places.)

Definitions:

WACC

A method for calculating a business's cost of capital, the Weighted Average Cost of Capital involves proportionally weighting each form of capital.

Miller Model

A theory on dividend policy that integrates the effect of personal income tax to contrast the Modigliani-Miller dividend irrelevance theory.

Personal Taxes

Taxes levied on the income or assets of individuals, as opposed to taxes imposed on companies.

Corporate Debt

Financial obligations incurred by companies through borrowing, issuing bonds, or other financial instruments to support operations or growth.

Q1: Hagy Corporation has an activity-based costing system

Q18: One of the weaknesses of budgets is

Q81: Luchini Corporation makes one product and it

Q88: Hane Corporation uses the following activity rates

Q98: Caruso Incorporated, which produces a single product,

Q172: The direct labor budget shows the direct

Q280: Goertz Corporation has an activity-based costing system

Q301: Janos Corporation, which has only one product,

Q345: Thorman Corporation is a service company that

Q371: Hislop Tech is a for-profit vocational school.