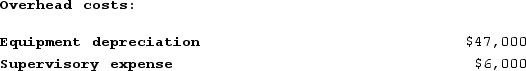

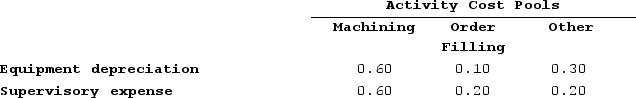

Lysiak Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment depreciation and supervisory expense-are allocated to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

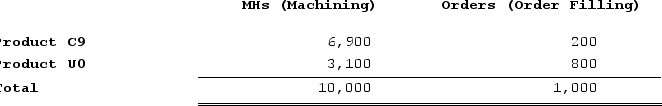

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Retractors

Surgical instruments used to separate the edges of a surgical incision or wound, or to hold back underlying organs and tissues so that body parts under the incision may be accessed.

Clamping

The action of securing objects tightly together using a clamp to hold, support, or compress them during various operations or processes.

Grasping

The action of seizing or holding firmly, often used in contexts of manipulation of objects or tools.

Cutting

The act of severing or dividing something with a sharp instrument.

Q64: The costing method that treats all fixed

Q72: Allocating common fixed expenses to business segments:<br>A)

Q74: Bramble Corporation is a small wholesaler of

Q82: Farris Corporation, which has only one product,

Q134: In the second-stage allocation in activity-based costing,

Q135: BW Department Store expects to generate the

Q231: Krueger Corporation is conducting a time-driven activity-based

Q280: Rokosz Corporation makes one product and it

Q303: Angara Corporation uses activity-based costing to determine

Q345: Thorman Corporation is a service company that