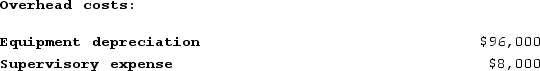

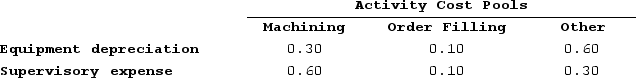

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

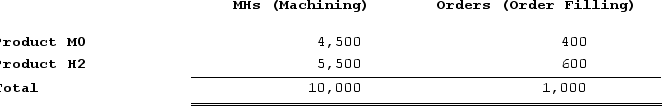

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

Definitions:

Unrealized Gain/Loss

A profit or loss that results from holding an investment that has not yet been sold, and thus, the gain or loss is not reflected in the financial statements.

Government Bonds

Debt securities issued by a government to support government spending, considered low-risk investments since they are backed by the taxing power of the issuing government.

Corporate Bonds

Debt securities issued by corporations to finance their operations, which pay interest to investors until maturity.

Available-For-Sale

A classification of securities which are not actively traded by the company, with changes in value reported in other comprehensive income.

Q80: The first-stage allocation in an ABC system

Q86: Mirabile Corporation uses activity-based costing to compute

Q127: Bries Corporation is preparing its cash budget

Q145: The manufacturing overhead budget at Polich Corporation

Q213: Under variable costing, fixed manufacturing overhead is

Q248: Delisa Corporation has two divisions: Division L

Q251: Bux Corporation produces and sells one product.

Q281: Salina Clinic uses patient-visits as its measure

Q294: Abel Corporation uses activity-based costing. The company

Q317: Neef Corporation has provided the following data