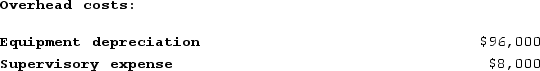

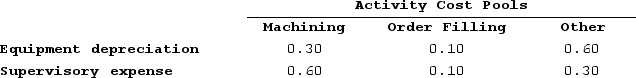

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

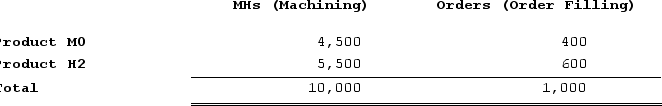

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H2 under activity-based costing?

What is the overhead cost assigned to Product H2 under activity-based costing?

Definitions:

Interest Computation

The process of calculating the interest payable on a loan or earned on an investment, based on the principal, rate, and time.

Maturity Date

The date on which a financial obligation must be repaid or settled in full.

Leap Years

Years that are divisible by 4 (except for years divisible by 100, unless they are also divisible by 400), having 366 days to keep the calendar year synchronized with the astronomical year.

Maturity Value

The total amount that will be received at the maturity date of an investment, including the principal and any accrued interest.

Q77: Hesterman Corporation makes one product and has

Q87: Greife Corporation's activity-based costing system has three

Q128: In a Capacity Analysis report in time-based

Q128: Davis Corporation is preparing its Manufacturing Overhead

Q172: Laizure Clinic uses patient-visits as its measure

Q245: Corvi Corporation produces and sells one product.

Q249: Hagy Corporation has an activity-based costing system

Q272: Under variable costing, an increase in fixed

Q286: Clenney Corporation uses a plantwide overhead rate

Q356: Machining a part for a product is