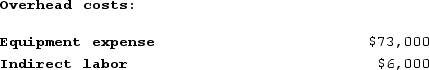

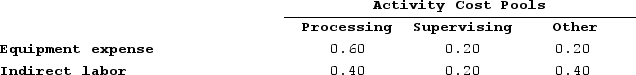

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

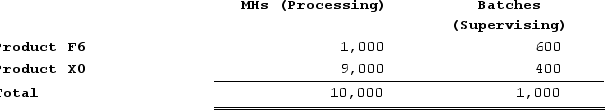

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

Definitions:

Pitch

Outreach from a PR professional to reporters to get them to consider a story idea they are proposing to seek news coverage.

Business Wire

A company that distributes press releases and corporate information to news organizations, journalists, and the public.

Advertising Value Equivalence

A metric used in public relations to equate the value of editorial content or earned media to the cost of equivalent advertising space or time.

Key Message Visibility

Key message visibility refers to the extent to which an organization's core messages are effectively communicated and recognized by its target audience, playing a critical role in branding and public relations efforts.

Q16: Hayworth Corporation has just segmented last year's

Q18: Tullio Corporation is conducting a time-driven activity-based

Q86: Mirabile Corporation uses activity-based costing to compute

Q99: Spigelmyer Enterprises makes a variety of products

Q116: Bennette Corporation has provided the following data

Q120: Baraban Corporation has provided the following data

Q145: Danahy Corporation manufactures a single product. The

Q213: Desjarlais Corporation uses the following activity rates

Q258: Activity-based costing is best proposed, designed and

Q280: Croft Corporation produces a single product. Last